Rumored Buzz on USDA Loans - Mid America Mortgage

Getting My 4 Common Myths About USDA Home Loans - Cherry Creek To Work

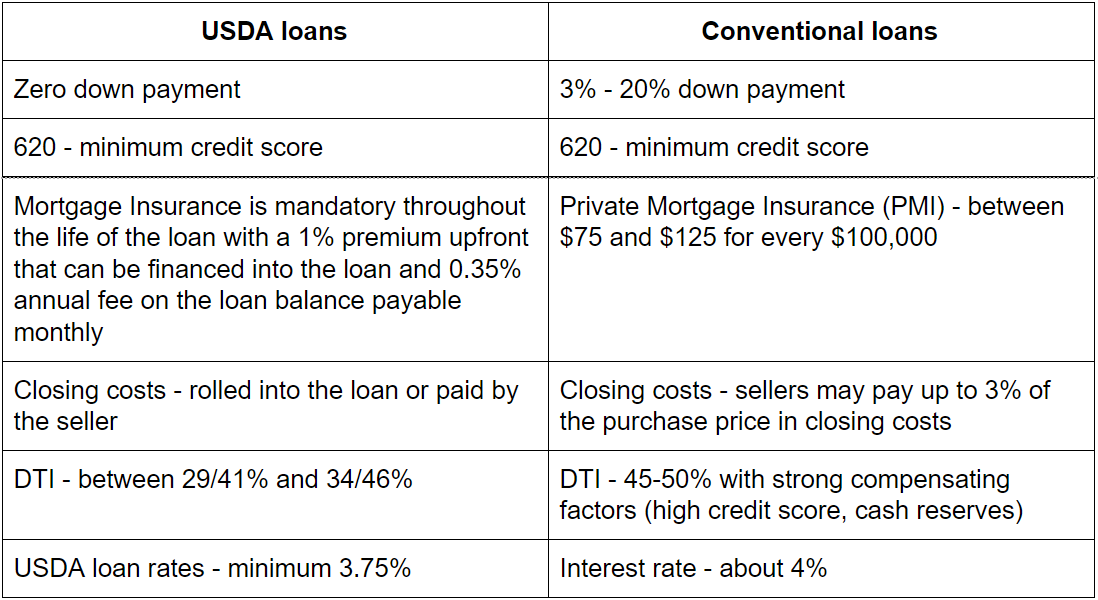

The USDA home mortgage program was created to make homeownership available, not unobtainable. Relative to numerous mortgage programs, USDA credit credentials are less rigid. The USDA home mortgage program sets closing expense thresholds and provides numerous ways to address them. Beyond out of pocket, choices include household presents, seller concessions, and financing when assessed value supports.

USDA Loans USDA Rural Advancement has actually partnered with regional lenders to help them extend 100% funding opportunities to rural individuals and families. The home itself must meet USDA place and condition requirements. There are numerous favorable elements to obtaining USDA loans if you are not eligible for a Standard Loan, however there are income restrictions and constraints that differ by various counties and the number of family members that will reside in the household.

Kentucky USDA Rural Housing Mortgage Lender: Difference Between 502 Guarantee Loan and Direct Loan for RHS USDA Loan in Kentucky

USDA charges a yearly service charge of. 35% of the total loan amount, which is paid monthly. USDA likewise charges an in advance funding charge of 1% of the loan amount. This is a one-time cost and can be rolled into the loan. Advantages of USDA House Loans Customers with lower or no credit history who can't certify for conventional loans.

Single Family Housing Guaranteed Loan Program - FDIC Things To Know Before You Buy

Clients with little or no cash for down payment. Newbie property buyers are looking for more cost effective regular monthly payments. USDA House Loans Extra Details If the residential or commercial property you are acquiring appraises well above the negotiated sales cost, a USDA home loans is the only program that enables the choice of funding other appropriate closing costs and pre-paid, above the loan amount and warranty charge.

Accepts lower credit history compare many other loan providers. Uses very aggressive rates. Offers lower or no lender fees for USDA loan. Apply for USDA Loans U.S.A. Home loan Columbia local workplace has numerous areas in the states of Missouri, Arkansas, Illinois, and Kentucky. You Can Try This Source have all the resources required to make your dream a truth.

USDA home loans on hold due to government shutdown

Apply now and learn if you certify for a USDA rural advancement (RD) Home mortgage.

Tumblr - Usda loan, Usda, Home loans

The Ultimate Guide To Pros and Cons of USDA Loans - Veterans United

What Are USDA House Loans? USDA home mortgages are an excellent way for rural homeowners to get up to 100% financing and a number of other benefits on a brand-new home! Whether you're looking to buy, develop, fix, refurbish, or even move a home, a USDA rural mortgage from Cross, Nation Mortgage can assist you make your homeownership dreams come to life.